Georgia payroll calculator 2023

Prepare and e-File your. Hawaii Paycheck Calculator 2022 - 2023 Everything you need to know about Hawaii paycheck calculations is as follows.

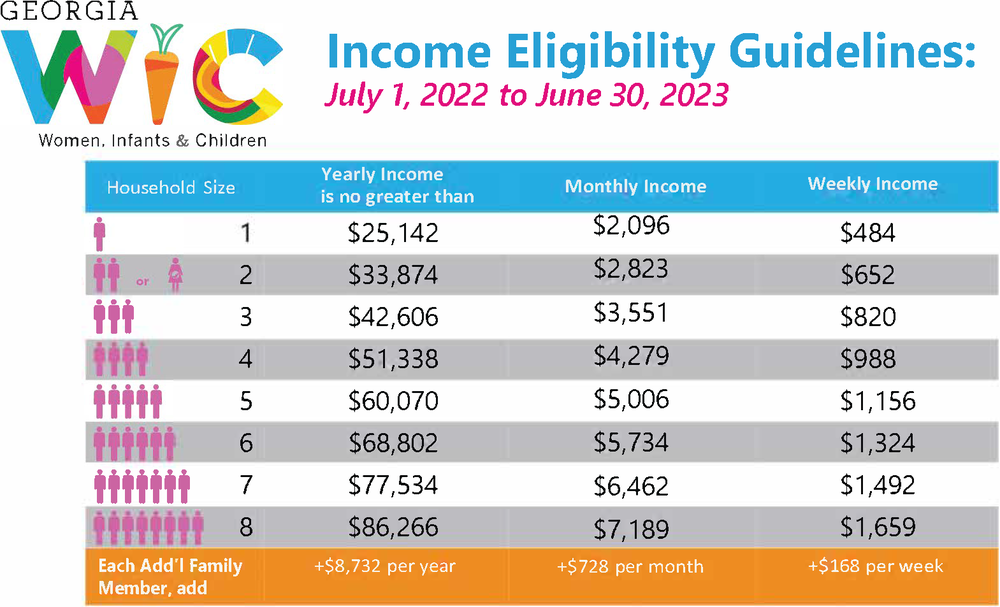

Eligibility Income Guidelines Georgia Department Of Public Health

Employers also have to pay a matching 62 tax up to the wage limit.

. Zrivo Paycheck Calculator. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. All Services Backed by Tax Guarantee.

It will be updated with 2023 tax year data as soon the data is available from the IRS. Georgia tax year runs from July 01 the year before to June 30 the current year. Ad Compare This Years Top 5 Free Payroll Software.

Once students are eligible to take major-level Computer Science courses CSC 2720 and 3000- and. Prepare and e-File your. Calculating your Georgia state.

Georgia Salary Paycheck Calculator. Georgia Payroll Calculator Tax Rates Use our easy payroll tax calculator to quickly run payroll in Georgia or look up 2021 state tax. This Tax Return and Refund Estimator is currently based on 2022 tax tables.

Get Started With ADP Payroll. This Tax Return and Refund Estimator is currently based on 2022 tax tables. It will be updated with 2023 tax year data as soon the data is available from the IRS.

Enter your info to see your. The Georgia Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2022 and Georgia State. Ad Payroll So Easy You Can Set It Up Run It Yourself.

The 2022 Tax Calculator uses the 2022 Federal Tax Tables and 2022 Federal Tax Tables you can view the latest tax tables and historical tax tables used in our tax and salary calculators. The Salary Calculator is an excellent tool for identifying how your payroll deductions and income taxes are split up with details of how each is calculated and the. Ad Compare This Years Top 5 Free Payroll Software.

Ad Payroll So Easy You Can Set It Up Run It Yourself. Outlook for the 2023 Georgia income tax rate. Free Unbiased Reviews Top Picks.

Temporary Salary Supplement - One year status check 81 KB Microsoft Word Document 85 KB. Ad Process Payroll Faster Easier With ADP Payroll. So the tax year 2022 will start from July 01 2021 to June 30 2022.

Medicare tax which is 145 of each employees taxable wages up to 200000 for the year. Ad Process Payroll Faster Easier With ADP Payroll. Georgia annualmonthly salary schedule for 10 months employment base equals school year level of certification salary step t.

Temporary Salary Supplement 195 KB Microsoft Word Document 85 KB. Hourly employees who work more than 40 hours per week are paid at 15 times the regular pay rate. Free Unbiased Reviews Top Picks.

Kansas paycheck calculator is a helpful tool for employers to use to calculate the amount of net pay they must withhold from an employees. Discover ADP Payroll Benefits Insurance Time Talent HR More. All Services Backed by Tax Guarantee.

Fy 2022 state salary schedule folder name. Georgia Paycheck Calculator - SmartAsset SmartAssets Georgia paycheck calculator shows your hourly and salary income after federal state and local taxes. Discover ADP Payroll Benefits Insurance Time Talent HR More.

For 2022 the minimum wage in Georgia is 725 per hour. Michelle Adams Last Updated. Get Started With ADP Payroll.

Georgia Payroll Tax Rates. This guide is used to explain the guidelines for Withholding Taxes. Free Georgia Payroll Tax Calculator and GA Tax Rates.

Georgia payroll calculator 2023 Tuesday September 6 2022 Edit. 2022 Employers Tax Guidepdf 155 MB 2021 Employers Tax Guidepdf 178 MB. Calculate your Georgia net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state.

2

Federal Register Medicare Program Prospective Payment System And Consolidated Billing For Skilled Nursing Facilities Updates To The Quality Reporting Program And Value Based Purchasing Program For Federal Fiscal Year 2023 Changes To

State Corporate Income Tax Rates And Brackets Tax Foundation

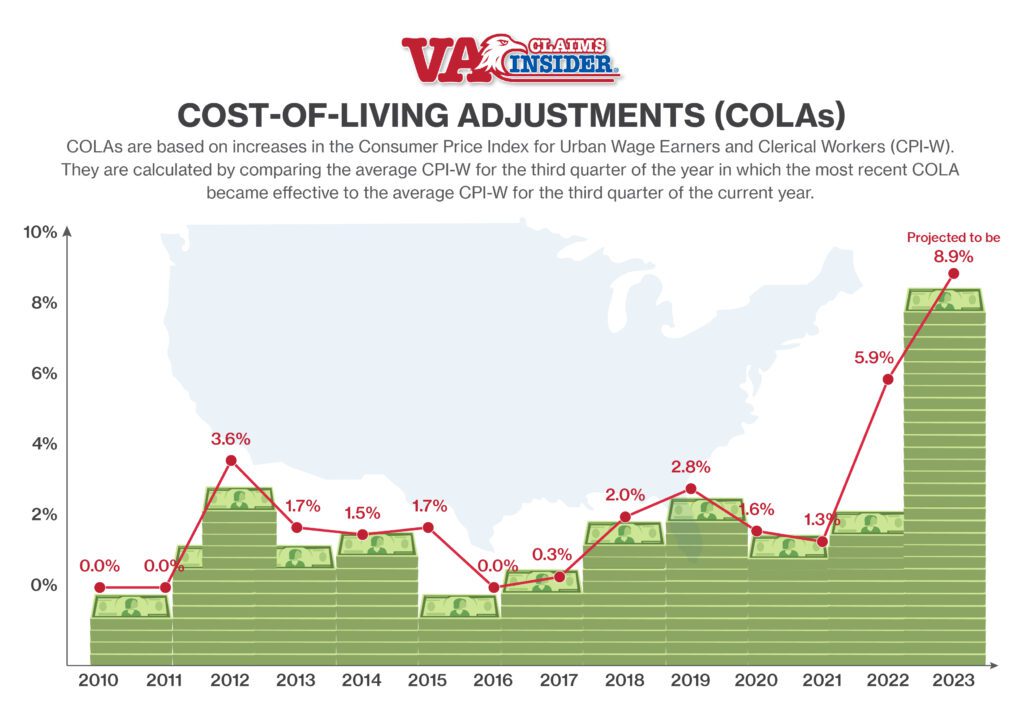

When Is Social Security Increase For 2023 Announced Cola May Be Most In 40 Years Oregonlive Com

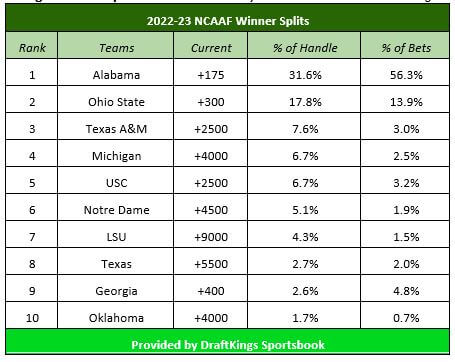

2023 College Football Championship Odds Track Ncaaf Favorites

Estimated Income Tax Payments For 2022 And 2023 Pay Online

Federal Register Medicare Program Prospective Payment System And Consolidated Billing For Skilled Nursing Facilities Updates To The Quality Reporting Program And Value Based Purchasing Program For Federal Fiscal Year 2023 Changes To

Moaa Here S Why Your Medicare Part B Costs May Drop In 2023

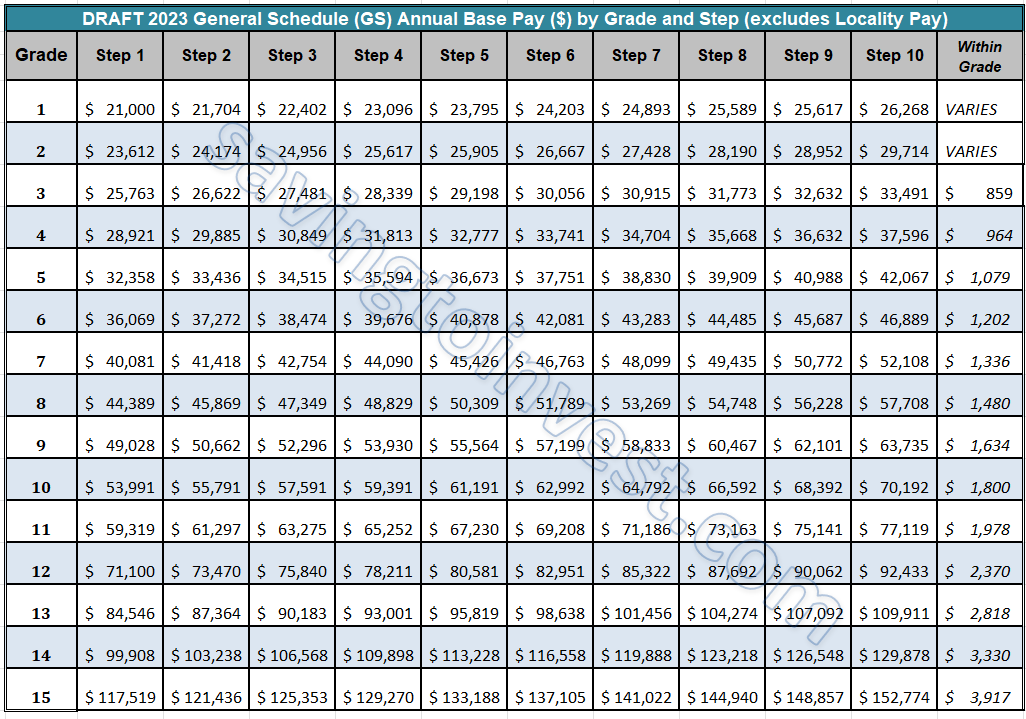

2023 Raise For 2022 Gs Federal Employee Pay Scale Latest Updates And News Aving To Invest

Calculator And Estimator For 2023 Returns W 4 During 2022

Cola Prediction What Is The Expected Ss Cola For 2023 Marca

Companies Plan To Give Big Raises In 2023 Amid Inflation Money

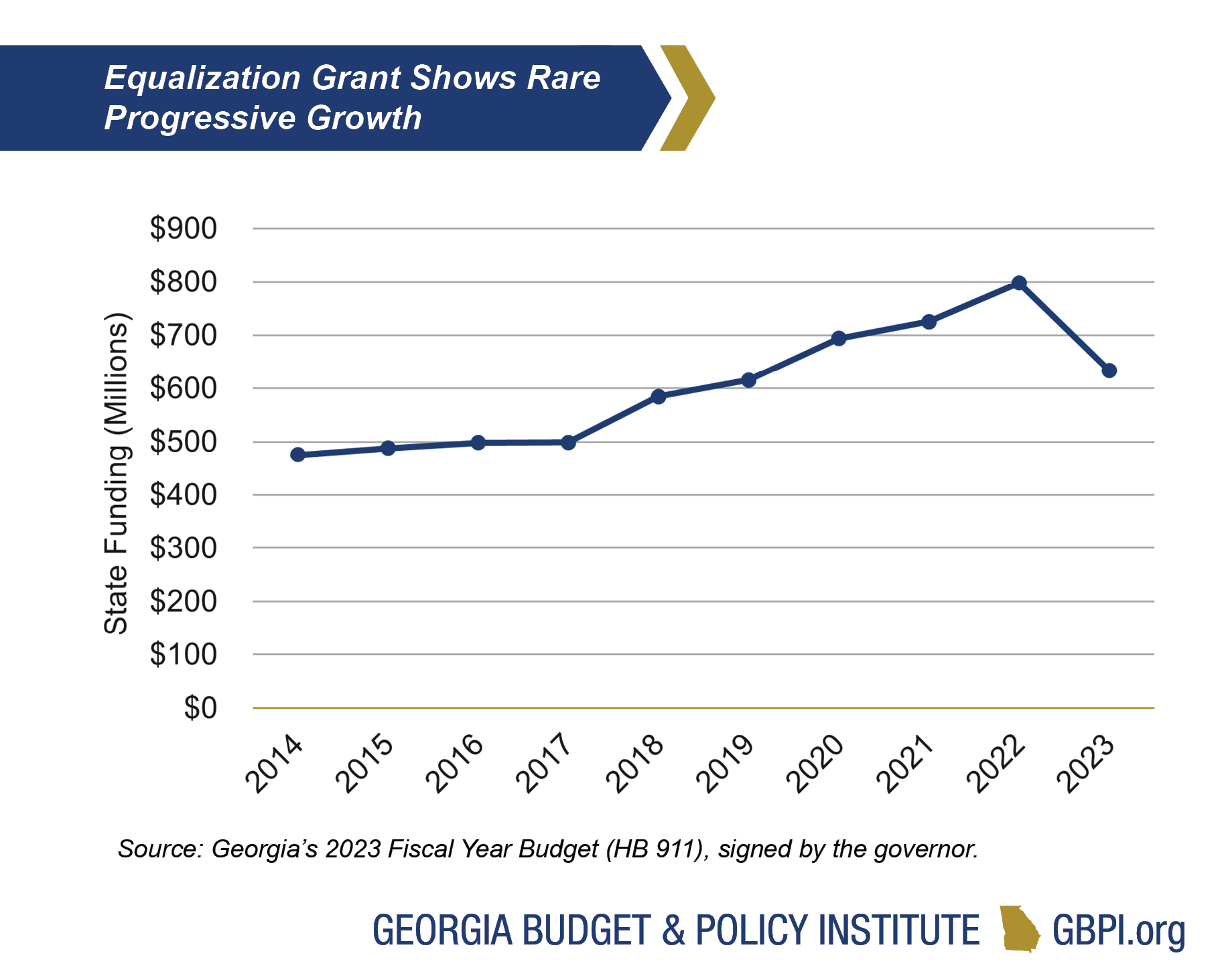

Georgia Education Budget Primer For State Fiscal Year 2023 Georgia Budget And Policy Institute

Georgia State University Holidays 2020 Georgia State University Georgia State State University

2023 Toyota Sequoia Specs Pre Order Release Date

Will There Be A 2023 Cola Increase Massive 8 9 Social Security Increase Could Be Coming Va Claims Insider

1